Closing Costs

Our list of CLOSING COSTS1 is a summary of customary closing costs in typical New York real estate transactions. Click on the following types of sales / purchases for more information on associated closing costs:

- CONDOMINIUM / TOWNHOUSE PURCHASER

- PURCHASE OF NEW CONSTRUCTION / CONVERSION CONDOMINIUM FROM SPONSOR

- CO-OP PURCHASER

- CONDOMINIUM / TOWNHOUSE SELLER

- CO-OP SELLER

-

-

CONDOMINIUM / TOWNHOUSE PURCHASER

- Purchaser’s Attorney: Attorney fees vary. Some attorneys bill on an hourly basis. Most attorneys handling residential real estate transactions charge a flat fee for the entire transaction. Flat fees can range from as low as $1,500 (usually charged by lawyers who don’t actually do any legal work or review any documents, but just have their paralegals or legal assistants process the transaction), to $5,000 or more. As with any other type of service, the old adage “you get what you pay for” applies. At the Law Firm of Alexander Suslensky, PC, we typically charge a reasonable flat fee for most residential real estate transactions which is based upon the nature of the transaction and our experience of “closing real estate deals all day, every day” since 2002.

- Lender Fees: See “Loan Estimate” from Lender because it varies; approximate charges below (some fees may not be charged):

- Commitment Fee: $350 – $750

- Application Fee: $350 – $600

- Processing/Doc Prep Fee: $350 – $600

- Appraisal Fee: $300 – $1,500 (depending on sales price; type of property)

- Credit Report Fee: $10 – $100

- Bank Attorney: $850 – $1,500

- Tax Escrows: 2 to 6 months

- Homeowner’s Insurance Escrows: 2 to 6 month

- Short Term Interest: Equal to interest for balance of month in which you close

- Title Charges:

- Fee Title Insurance: Regulated by NYS law; approx. $450 per $100,000 of sales price under 1M, +15% on $1M or more (e.g. on $1M purchase, owner’s title insurance policy premium = $4,508.00)

- Mortgage Title Insurance: Regulated by NYS law; approx. $130 per $100,000 of mortgage amount (e.g. on $800,000 mortgage loan, lender’s title insurance premium = $931.00)

- Endorsements: $75 – $150

- Recording Fees: $750 – $1,000

- Municipal Search/Departmentals: $350 – $550

- Bankruptcy Search: $50 + (per purchaser)

- Patriot Act Search: $50 + (per purchaser)

- Escrow Service Charge: $75 – $150 (if required by lender or requested by purchaser)

- Express Delivery: $60 – $150

- Sales Tax: approx. $40 (8.875% of qualifying services)

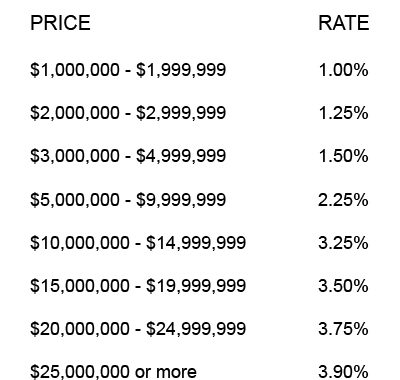

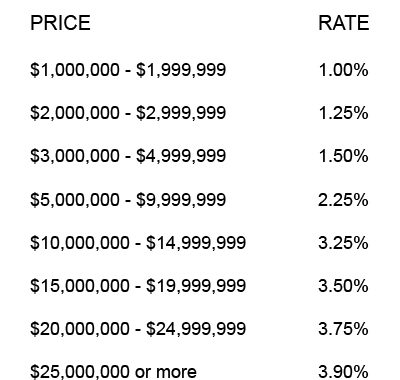

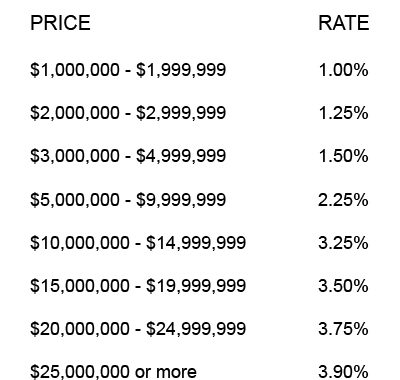

- Mansion Tax:

- Mortgage Tax2:

- NYC Mortgage Tax:

- Mortgage less than $500,000 = 1.80%

- Mortgage $500,000+ on 1-3 family residential dwelling = 1.925%

- Mortgage on all other property over $500,000.00 = 2.80%

- Nassau and Suffolk Counties Mortgage Tax:

- 1-3 family residential dwelling = 0.80% on entire mortgage amount

- 3 or more family residential dwelling, commercial or vacant land = 1.05% on entire mortgage amount

- Rockland and Westchester Counties Mortgage Tax:

- 1-3 family residential dwelling = 1.05% on entire mortgage amount

- 3 or more family residential dwelling, commercial or vacant land = 1.30% on entire mortgage amount

- NYC Mortgage Tax:

- Peconic Bay Tax: 2% (paid by buyer), subject to the following exemptions:

- Shelter Island, Southampton and East Hampton: $250,000 for improved property and $100,000 for unimproved property

- For more information on exemptions for first time homebuyers in the towns of Southampton, East Hampton and Shelter Island, please call our offices.

- Southold and Riverhead: $150,000 for improved property and $75,000 for unimproved property

- Common Charge Adjustment: Pro-rated for the month of closing

- Real Estate Tax Adjustment: Pro-rated depending on when the tax is collected

- Miscellaneous Condominium Charges: Vary by building

- Survey (if house and acceptable, recent copy is not otherwise available) = approx. $1,000

The applicable exemption amount is subtracted from the purchase price; then calculate the 2% tax

-

PURCHASE OF NEW CONSTRUCTION / CONVERSION CONDOMINIUM FROM SPONSOR

- Purchaser’s Attorney: Attorney fees vary. Some attorneys bill on an hourly basis. Most attorneys handling residential real estate transactions charge a flat fee for the entire transaction. Flat fees can range from as low as $1,500 (usually charged by lawyers who don’t actually do any legal work or review any documents, but just have their paralegals or legal assistants process the transaction), to $5,000 or more. As with any other type of service, the old adage “you get what you pay for” applies. At the Law Firm of Alexander Suslensky, PC, we typically charge a reasonable flat fee for most residential real estate transactions which is based upon the nature of the transaction and our experience of “closing real estate deals all day, every day” since 2002.

- Lender Fees: See “Loan Estimate” from Lender because it varies; approximate charges below (some fees may not be charged):

- Commitment Fee: $350 – $750

- Application Fee: $350 – $600

- Processing/Doc Prep Fee: $350 – $600

- Appraisal Fee: $300 – $1,500 (depending on sales price; type of property)

- Credit Report Fee: $10 – $100

- Bank Attorney: $850 – $1,500

- Short Term Interest: Equal to interest for balance of month in which you close

- Title Charges:

- Fee Title Insurance: Regulated by NYS law; approx. $450 per $100,000 of sales price under 1M, +15% on $1M or more (e.g. on $1M purchase, owner’s title insurance policy premium = $4,508.00)

- Mortgage Title Insurance: Regulated by NYS law; approx. $130 per $100,000 of mortgage amount (e.g. on $800,000 mortgage loan, lender’s title insurance premium = $931.00)

- Endorsements: $75 – $150

- Recording Fees: $750 – $1,000

- Municipal Search/Departmentals: $350 – $550

- Bankruptcy Search: $50 + (per purchaser)

- Patriot Act Search: $50 + (per purchaser)

- Escrow Service Charge: $75 – $150 (if required by lender or requested by purchaser)

- Express Delivery: $60 – $150

- Sales Tax: approx. $40 (8.875% of qualifying services)

- NYC & NYS Transfer Taxes: not required but customary (negotiable). See SELLER Sections for detailed rates. Pursuant to the regulations, when a purchaser pays transfer taxes, the tax is calculated on the purchase price, added to the purchase price, and then calculated on the “gross-up” purchase price. For example, on $1M purchase:

- NYC Transfer Tax = $14,510.06 (would be $14,250 if Seller pays)

- NYS Transfer Tax = $4,073.00 (would be $4,000.00 if Seller pays)

- Mansion Tax:

*** Based upon “grossed up” price if purchaser paying NYC and NYS transfer taxes and possibly other seller closing costs.

- Mortgage Tax2:

- NYC Mortgage Tax:

- Mortgage less than $500,000 = 1.80%

- Mortgage $500,000+ on 1-3 family residential dwelling = 1.925%

- Mortgage on all other property over $500,000.00 = 2.80%

- Nassau and Suffolk Counties Mortgage Tax:

- 1-3 family residential dwelling = 0.80% on entire mortgage amount

- 3 or more family residential dwelling, commercial or vacant land = 1.05% on entire mortgage amount

- Rockland and Westchester Counties Mortgage Tax:

- 1-3 family residential dwelling = 1.05% on entire mortgage amount

- 3 or more family residential dwelling, commercial or vacant land = 1.30% on entire mortgage amount

- NYC Mortgage Tax:

- Sponsor’s Attorney Fee: not required but customary (negotiable). $2,500 – $6,000

- Working Capital Contribution: usually 2 months’ common charges

- Other Sponsor Charges: may apply (e.g. tax abatement attorney reimbursement, offering plan attorney reimbursement, plumbing connection reimbursement, etc.)

- Common Charge Adjustment: Pro-rated for the month of closing

- Real Estate Tax Adjustment: Pro-rated depending on when the tax is collected

- Sometimes, pro-rata building insurance adjustment

-

CO-OP PURCHASER

- Purchaser’s Attorney: Attorney fees vary. Some attorneys bill on an hourly basis. Most attorneys handling residential real estate transactions charge a flat fee for the entire transaction. Flat fees can range from as low as $1,500 (usually charged by lawyers who don’t actually do any legal work or review any documents, but just have their paralegals or legal assistants process the transaction), to $5,000 or more. As with any other type of service, the old adage “you get what you pay for” applies. At the Law Firm of Alexander Suslensky, PC, we typically charge a reasonable flat fee for most residential real estate transactions which is based upon the nature of the transaction and our experience of “closing real estate deals all day, every day” since 2002.

- Lender Fees: See “Good Faith Estimate” from Lender because it varies; approximate charges below (some fees may not be charged):

- Commitment Fee: $350 – $750

- Application Fee: $350 – $600

- Processing/Doc Prep Fee: $350 – $600

- Appraisal Fee: $300 – $1,500 (depending on sales price; type of property)

- Credit Report Fee: $10 – $100

- Bank Attorney: $850 – $1,500

- Short Term Interest: Equal to interest for balance of month in which you close

- Mansion Tax:

- Lien/Judgment Search: $275 – $500

- UCC-1 Filing: $75 – $150

- Miscellaneous Co-op Charges: Vary by building (e.g. move-in fee, refundable move-in deposit, etc.)

- Recognition Agreement Fee: $200 – $400

- Maintenance Adjustment: Pro-rated for the month of closing

- Co-op Flip Tax: Building may not have. If it exists, negotiable between buyer and seller. If it exists, varies by building and may be based upon purchase price, number of shares, net gain, flat fee or some other calculation determined by co-op.

- *** Notice no title insurance4 or mortgage tax on co-op’s ***

-

CONDOMINIUM / TOWNHOUSE SELLER

- Broker Commission: usually 6% or less

- Seller’s Attorney: Attorney fees vary. Some attorneys bill on an hourly basis. Most attorneys handling residential real estate transactions charge a flat fee for the entire transaction. Flat fees can range from as low as $1,500 (usually charged by lawyers who don’t actually do any legal work or review any documents, but just have their paralegals or legal assistants process the transaction), to $5,000 or more. As with any other type of service, the old adage “you get what you pay for” applies. At the Law Firm of Alexander Suslensky, PC, we typically charge a reasonable flat fee for most residential real estate transactions which is based upon the nature of the transaction and our experience of “closing real estate deals all day, every day” since 2002.

- NYC Transfer Tax:

- Residential:

- Up to $500,000 = 1%

- $500,000+ = 1.425%

- Commercial:

- Up to $500,000 = 1.425%

- $500,000+ = 2.625%

- Residential:

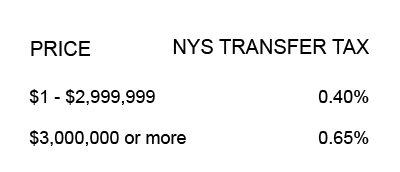

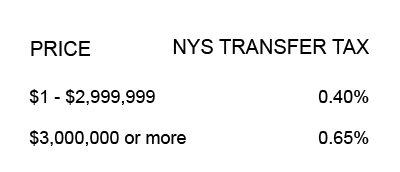

- NY State Transfer Tax:

- Filing Fees: $125 – $250

- Mortgage Satisfaction Fee: $250+ per mortgage

- Pick-up/Payoff Fee: $250+ per mortgage

- Miscellaneous Condominium Charges: Vary by building (e.g. move-out fee, refundable move-out deposit, managing agent transfer fees, etc.)

- FIRPTA: Only applies to U.S. non-resident aliens, in which case, 10% or 15% of the purchase price (depending on purchase price and/or buyer’s intent to occupy as primary residence) or Withholding Certificate amount (subject to exceptions).

- NYS Non-Resident Withholding: Non-New York State residents must pay 8.82% of net gain, if any (in 2016) AT CLOSING. New York State residents pay this tax, if any, when they file their annual tax returns.

-

CO-OP SELLER

- Broker Commission: Usually 6% or less

- Seller’s Attorney: Attorney fees vary. Some attorneys bill on an hourly basis. Most attorneys handling residential real estate transactions charge a flat fee for the entire transaction. Flat fees can range from as low as $1,500 (usually charged by lawyers who don’t actually do any legal work or review any documents, but just have their paralegals or legal assistants process the transaction), to $5,000 or more. As with any other type of service, the old adage “you get what you pay for” applies. At the Law Firm of Alexander Suslensky, PC, we typically charge a reasonable flat fee for most residential real estate transactions which is based upon the nature of the transaction and our experience of “closing real estate deals all day, every day” since 2002.

- NYC Transfer Tax:

- Residential:

- Up to $500,000 = 1%

- $500,000+ = 1.425%

- Commercial:

- Up to $500,000 = 1.425%

- $500,000+ = 2.625%

- Residential:

- NY State Transfer Tax:

- Filing Fee: $100

- Payoff Attorney Fee: $350 – $700 per loan

- UCC-3 Filing Fee: $75 – $150 per UCC-1

- Co-op Flip Tax: Building may not have. If it exists, negotiable between buyer and seller. If it exists, varies by building and may be based upon purchase price, number of shares, net gain, flat fee or some other calculation determined by co-op.

- Miscellaneous Co-op Charges: vary by building (e.g. move-out fee, refundable move-out deposit, transfer agent transfer fees, etc.)

- FIRPTA: Only applies to U.S. non-resident aliens, in which case, 10% or 15% of the purchase price (depending on purchase price and/or buyer’s intent to occupy as primary residence) or Withholding Certificate amount (subject to exceptions).

- NYS Non-Resident Withholding: Non-New York State residents must pay 8.82% of net gain, if any (in 2016) AT CLOSING. New York State residents pay this tax, if any, when they file their annual tax returns.

-

- Disclaimer: This is intended to be a general summary of customary closing costs incurred in typical New York real estate transactions. Every transaction is different. Therefore, a reputable attorney should be consulted for a more precise estimate of closings costs with respect to a particular transaction.

- The lender may be required to pay 0.25% of the mortgage tax when the property has 6 residential units or less with separate cooking facilities. When the mortgage recites that the real property is or will be improved by a one-to-two family residence, there is an exemption of $25 or $30, depending on the County.

- Be aware of situations in which the price is under $1M, but “grossed up” price becomes over $1M and thereby incurs Mansion Tax.

- There is a product for co-op’s similar to title insurance called leasehold insurance, but it is not typically required and rarely purchased. A reputable attorney should be consulted to understand if this product should be purchased.